Expected Values for Lotteries

Expected Value is one way to compare lotteries in Decision Trees

Define :

- $EV(l) = \sum_{x \in X} x \cdot p_l(x)$

- $l_1 \ P \ l_2 \iff EV(l_1) > EV(l_2)$ - the preference relation

- $l_1 \ I \ l_2 \iff EV(l_1) = EV(l_2)$ - the indifference relation

So essentially this is the Weighted Sum Model where weights are probabilities

- that helps to establish preferences between lotteries

Advantages

- simple

- good use of information

Disadvantages

- limited to numerical consequences

- no clear rationale

Examples

Example 1

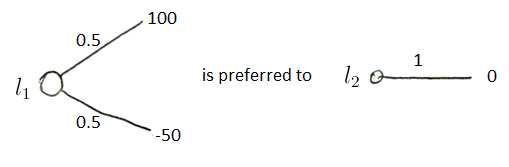

Consider two lotteries

- $l_1$ and $l_2$

- $l_1$ is a game when you can win 100 euro or lose 50

- $l_2$ is when you don’t play a game

- how to choose whether to play or not (i.e. choose $l_1$ or $l_2$)

- calculate the expected utility: $E(l_1) = 25, E(l_2) = 0$

- so $l_1 \ P \ l_2$

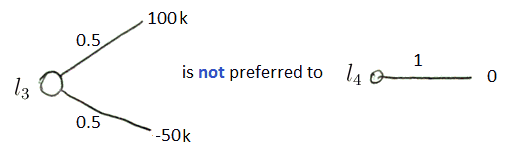

But consider two other lotteries

- $l_3$ and $l_4$

- this time you can win 100k euro or lose 50k

- according to expected value $E(l_3) = 20k > E(l_4) = 0$

- so we should prefer $l_3$ to $l_4$ ($l_3 \ P \ l_4$)

- but the cost of losing is too big - many people cannot afford to play such game

Many people would say

- $l_1 \ P \ l_2$

- but $l_4 \ P \ l_3$

We clearly see that EV is not enough to make a decision

Example 2

The Saint Petersburg Paradox also shows that EV is not a good measure

Expected Value + Variance

When we face such paradoxes we need to add some additional indicators

- such as Variance - to quantify the risk

This is less simple:

- now the problem is bi-objective

- need to use Multi-Objective Optimization techniques

Conclusions

We need to use a different approach